- LLCs with multiple assets may benefit from the holding company structure.

- The holding company structure segregates assets.

- If each LLC is properly formed and operated, the legal protection offered by the holding company structure is well-settled.

LLCs protect assets and limit liability. Forming a single LLC protects the owners (members) from personal liability for debts and obligations of the LLC. As long as the LLC is properly formed (including a well-drafted operating agreement) and managed, creditors of the LLC can only look to the LLC’s assets to satisfy claims against the LLC. Creditors cannot require the members to pay LLC debts from personal assets.

If an LLC owns a single asset, one LLC is often enough to provide liability protection. But what if the LLC owns multiple assets? Most experienced real estate investors own multiple properties. Holding these properties in a single LLC opens them all up to liability. If a lawsuit arises in connection with one property, a successful judgment creditor can look to the other properties to satisfy the debt.

When an LLC owns multiple assets, liability protection can be enhanced by separating those assets into different liability “containers.” Separating the assets helps isolate liability, so that a creditor with a claim against one asset cannot also look to the other assets to satisfy the claim. The holding company structure is the traditional way to segregate assets into separate containers.

How It Works

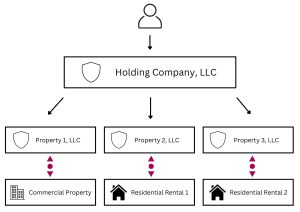

The holding company structure helps confine liability for each asset to that asset. Here’s how it works:

- One LLC is organized to serve as the parent holding company.

- The business owners hold all interests in the parent LLC.

- Separate subsidiary LLCs are formed to hold title to each high-risk asset (such as rental property) or business line.

- The parent holding company owns the subsidiary LLCs.

- High-risk assets are transferred into the subsidiary LLCs.

In the diagram above, the real estate investor owns three properties (one commercial and two residential rental properties). The investor forms four LLCs—one to serve as the parent LLC and three to serve as subsidiary LLCs—and places the real estate into the subsidiary LLCs. If a lawsuit arises against a subsidiary LLC, the plaintiffs can only look to the assets of that LLC. For example, if Property 1, LLC is successfully sued, the creditor can only look to the commercial property to satisfy the judgment. The creditor cannot look to the two residential properties that are owned by separate LLCs.

The holding company structure has been around a while and is fairly common in real estate transactions. Compared to series LLCs (discussed below), the protection offered by the holding company structure is relatively certain and applies in all states. As long as each LLC is properly formed and operated, the legal protection offered by the holding company structure is well-settled.

Holding Company Compared to Series LLC

Series LLCs are a relatively new form of LLC designed to provide similar protection to the holding company structure, but without requiring the formation of multiple LLCs. Instead of forming a parent LLC and multiple subsidiary LLCs, real estate investors can form a single series LLC and establish multiple series of assets within the LLC.

The goal of a series LLC is to separate assets so that the debts and obligations of one asset cannot infect other assets of the same company. Each series of a series LLC serves as liability container. Liabilities of one series are generally limited to the assets held by that series.

You can read more about series LLCs in our discussion of Series LLCs.