Business owners have two primary types of risk: Inside liability and outside liability. This article discusses these risks and how to protect against them using LLCs.

- Business owners face two types of risk: inside liability and outside liability.

- A properly formed and operated multi-member LLC protects owners’ personal assets from both inside and outside liability.

- A single-member LLC owner’s personal assets may not be protected from outside liability.

Forming a business can shield owners from personal liability. The first corporations were chartered in the 17th century to protect the shareholders from the corporation’s liabilities. As the law has evolved to accommodate more flexible and modern business structures—including LLCs—liability protection has remained at the forefront of business planning.

Protecting Against Inside Liability

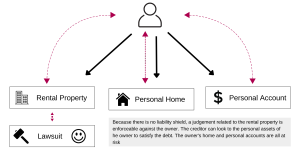

Inside liability is risk associated with the debts and obligations of the business. Without inside liability protection, a business owner can be personally liable for the business’s debts and obligations. In other words, the business owner’s personal assets are at risk.

Inside Liability

Historically, most businesses were formed to protect against inside liability. People formed corporations to take advantage of the corporate shield that would protect the shareholders from the business’s debts and obligations. This same type of protection was later extended to LLCs, which can provide better protection with more flexibility.

If a corporation or LLC is properly formed and operated, the business owner has no liability for the business obligations unless the owner signs in a personal capacity (for example, by signing a personal guarantee for a loan). The business debts and obligations are confined to the business. The owner’s non-business assets are not at risk for the business’s debts.

How LLCs Protect Against Inside Liability

As discussed below, while corporations and LLCs both protect against inside liability, LLCs can provide more protection than corporations when it comes to outside liability.

Protecting Against Outside Liability

Whereas inside liability deals with debts and obligations of the business, the second type of risk—often called outside liability—deals with the debts and obligations of the owners. Specifically, it deals with how an owner’s personal liability could affect the ongoing business operations or the other business owners.

When the creditor of an owner seizes that owner’s interest in a company, the creditor’s objective is to collect on the debt. This objective is likely to differ from the goals of remaining business owners, who are often interested in continuing to operate the business. Without outside liability protection, a creditor of an owner could seize his or her interest in the business and act in ways that are detrimental to the business. Depending on the circumstances, the creditor could force the business to liquidate or otherwise override the decisions of other business owners.

Outside Liability

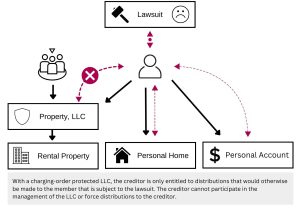

LLCs are the go-to business entity for outside liability protection. This is due to a remedy called a charging order, which LLCs borrow from partnership law. A charging order is a statutory remedy that limits an owner’s creditor to distributions that the owner would receive. Although the creditor will receive any distributions that would otherwise go to the owner, the creditor receives no management or voting rights and cannot force a liquidation. If the LLC is properly structured, the creditor is blocked from getting to the LLC’s underlying assets.

Charging Order Protection

As discussed below, it is important to understand the policy behind charging-order protection. Charging orders protect the business—and specifically the other business owners—from the repercussions of one owner’s legal problems. Without charging-order protection, innocent business owners would be unfairly penalized if another owner’s creditor could seize business assets. The charging order prevents this by limiting the creditor’s right to manage or otherwise interfere with the business. This limitation protects the other business owners from being forced into a partnership with the creditor.

Corporations do not provide the same protection against outside liability. The shareholder’s creditors can seize the shares held by the shareholder. When the creditor owns the shares, the creditor has all the management and voting rights associated with those shares. In most small businesses, the ownership rights associated with the shares creates a risk that the creditor could take control of the business or even liquidate the corporation to satisfy the judgment.

The charging-order protection offered by LLCs can be further bolstered by proper planning. For example, the LLC can be structured to be manager-managed and the operating agreement can be drafted to give the managers the control over when distributions will be made. Separating the economic ownership of the company from decision-making functions provides an added layer of protection. A creditor of a member would have no managerial rights. If the members are also the managers, there is no downside to using this structure.

The charging-order protection can also be enhanced by including provisions in the operating agreement that assign phantom income to the creditor. Phantom income is income that is taxable to the creditor, even if the creditor does not receive any economic distributions from the LLC. The possibility of incurring taxable phantom income without a mechanism to compel distributions could make an LLC interest an unattractive asset for a creditor and better protect the business.

Outside Liability and Single-Member LLCs

LLC law is based largely on partnership law. When state legislatures first authorized LLCs, they borrowed the charging-order remedy from partnership law. But there are important differences between LLCs and partnerships. By definition, a partnership requires at least two owners. An LLC, on the other hand, can be owned by a single owner (single-member LLC or SMLLC). Single-member LLCs are tax-efficient and provide the most flexible ownership structure for one-owner companies.

Single-member LLCs do not provide the same level of charging-order protection as multi-member LLCs. As mentioned above, the purpose of a charging order is to protect innocent owners from another owner’s legal problems. This rationale breaks down with a single-member LLC, because there are no other owners to protect.

Because charging-order protection is strongest with multi-member LLCs, single owners considering the LLC structure should add an additional member to help support charging-order protection. There are ways to add a member without sacrificing control or causing negative tax consequences. For example, a member could name his or her grantor trust or another LLC as the other member, thereby invoking the full charging-order protection of LLC law with little downside.

Single-member LLCs are also useful in more sophisticated business planning. They are often used as subsidiaries of parent companies in the holding company model, allowing them to segregate liability from different sources such as separate parcels of real estate or different lines of business. This structure does not rely on charging-order protection, but on the traditional inside liability protection offered by LLCs. This inside liability protection applies regardless of whether the LLC is a single-member LLC or multi-member LLC.