Texas LLC Certificate of Formation

An LLC is properly formed when its governing documents are in place. Texas law recognizes two governing documents: the formation document, which is filed with the Secretary of State to begin the LLC’s existence, and the operating agreement, which provides structure to the LLC and determines the governance and economic rights of the owners.1

In Texas, the formation document is called a certificate of formation. The certificate of formation is a simple notice that is filed with the Texas Secretary of State to officially form the LLC. Although it does little to structure the LLC, it is a necessary first step in Texas LLC formation. This article discusses the certificate of formation and its use in Texas LLC law.

The Texas LLC act uses the term company agreement to refer to the operating agreement. The company agreement deals with the internal operations of the LLC and governs such matters as responsibilities of the owners, control of the LLC, transfers of membership interest, tax classification, and distributions of LLC profits. The Texas LLC company agreement is the subject of our discussion of Texas LLC company agreements.

Texas LLC Certificate of Formation

As with other states, proper Texas LLC formation is a multi-step process. The first step consists of a relatively simple form with the Texas Secretary of State. This form—called a certificate of formation—informs the Texas Secretary of State and other third parties that the LLC exists and lets them know who to contact if needed.

The Texas Secretary of State publishes a simple, three-page version of the certificate of formation, accompanied by three pages of detailed instructions (see Form 205, Certificate of Formation, Limited Liability Company). Although nothing prevents LLC members from creating their own certificate of formation, almost all new Texas LLCs are created using the state-provided form.

By its own self-description, the state-provided form is designed only to cover “minimal statutory filing requirements.” It includes the following disclaimer:

The attached form is designed to meet minimal statutory filing requirements pursuant to the relevant code provisions. This form and the information provided are not substitutes for the advice and services of an attorney and tax specialist.

The certificate of formation says nothing about the rights and duties of the owners, control of the LLC, admission of new members, distribution of LLC profits, or other important matters. It assumes—as does the Texas Limited Liability Company Law—that details regarding the operation of the LLC will be specified in the LLC operating agreement.

Form 205 may be hand-delivered or mailed to the Texas Secretary of State’s office. If a Texas LLC attorney prepares the form, it is often filed electronically, without the need to file a paper copy. If filed electronically, the certificate of formation is usually approved within a few days and backdated to the filing date.

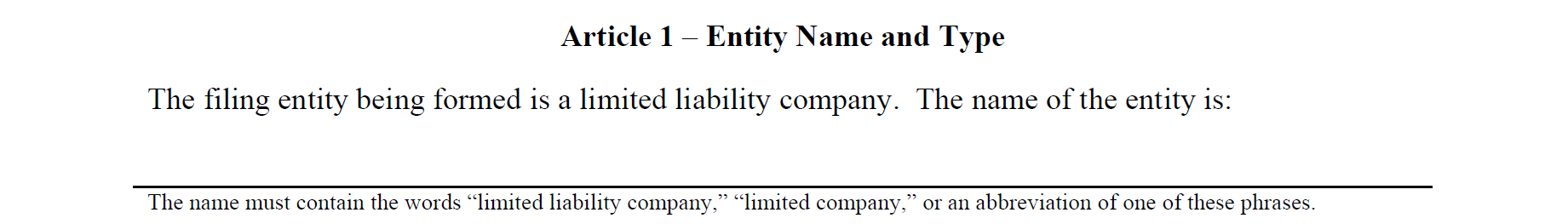

Article 1: The Name of the LLC

Article 1 asks for the entity name. Texas law requires an LLC to include specific words or abbreviations in the LLC’s name.2

For most LLCs, the name must include one of these phrases or abbreviations: “limited liability company,” “limited company,” “LLC,” “L.L.C.,” “LC,” “L.C.,” or “Ltd. Co.” In practice, most new LLCs will include the “LLC” abbreviation at the end of the name. Whether to include a comma before the abbreviation is a matter of preference.

For professional limited liability companies, the name must include one of the following: professional limited liability company, PLLC, or P.L.L.C. 3

Texas law also prohibits the use of certain LLC names. A Texas LLC may not have a name that:

- Contains the words “lotto” or “lottery;”4

- Implies that the LLC was created by or to benefit war veterans or their families or includes the words “veteran,” “legion,” “foreign,” “Spanish,” “disabled,” “war,” or “world war” (there are exceptions for pre-approval);5

- Implies that the LLC was created for a business that the LLC may not pursue (for example, an LLC could not be called “Travis Law Firm, PLLC” if it was not formed by attorneys to engage in the practice of law);6 or

- Is not distinguishable in the records of the Secretary of State from the name of another domestic or registered foreign filing entity, the fictitious name of a registered foreign entity, or a reserved or registered name.7

The last criteria—distinguishability in the records—was added on June 1, 2018. Before that, Texas law prohibited names that were the same as, similar to, or deceptively similar to the name of another entity or a name already reserved with the Secretary of State. The new standard removes the burden on the Secretary of State of deciding whether one business name unfairly competes with another, leaving that issue to Texas unfair competition and trademark law.

The name of the LLC need not be creative. For real estate investors using the traditional holding company structure, the LLC will often reference the property name. For example, if an LLC is formed to hold title to property with an address of 701 Brazos Street, the LLC may be named “701 Brazos Street LLC.”

Similarly, if a series of a Texas series LLC is being formed to hold title to property with a specific address, the series name may follow the same naming convention (for example, “701 Brazos Street LLC Series 2020B P.S.”). We discuss best naming practices in our article on what to name a series of a series LLC.

Confirm Name Availability

Before preparing documents, it is good practice to run a preliminary name check to make sure that the intended LLC name is available. A search of the Secretary of State records will provide the most coverage. Unlike many states, the Texas Secretary of State requires either an SOSDirect Account or a temporary login to run a name search. The cost is $1 per name search.

If the name is currently available but there will be a delay in filing, it may be beneficial to file a name reservation with the Texas Secretary of State to reserve the name until the initial documents are filed.

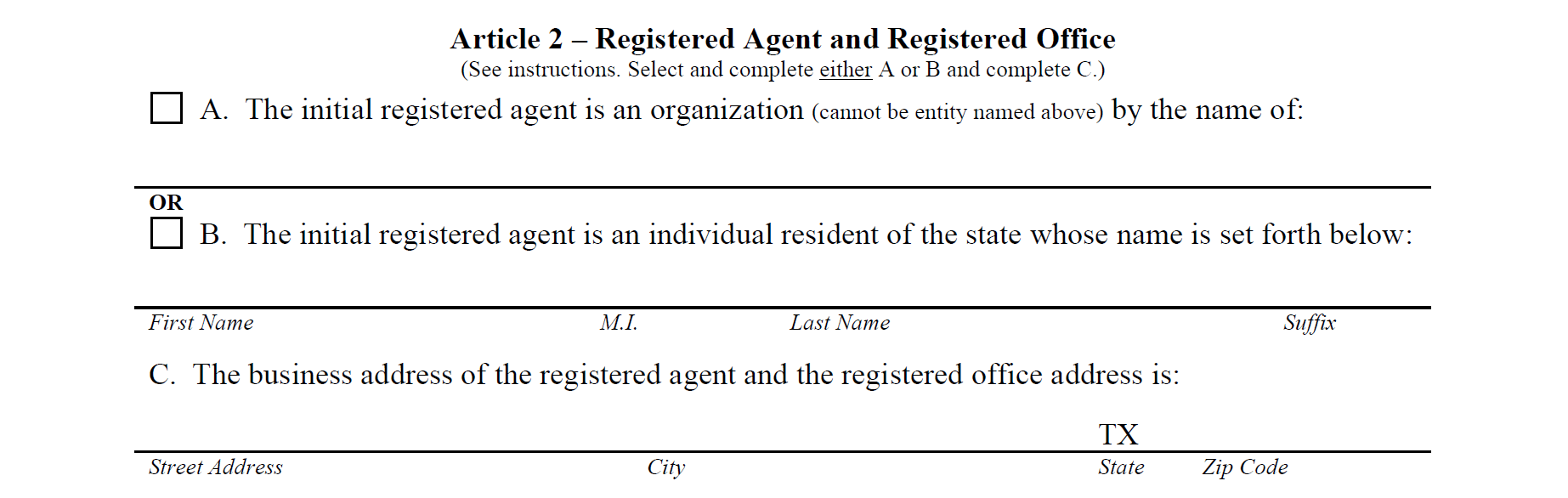

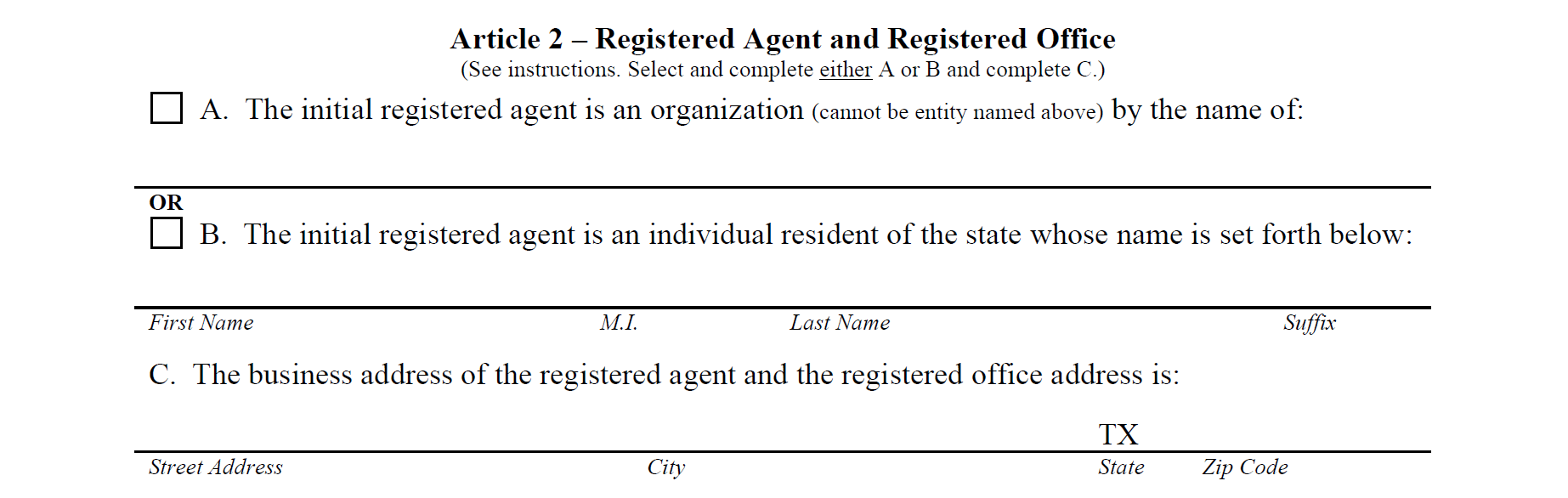

Article 2: Registered Agent and Registered Office

A registered agent is a person or organization designated to receive legal documents on behalf of the LLC. Every Texas LLC must have a registered agent. Texas law requires that the registered be:

- An individual who lives in Texas and has consented to serve as a registered agent; or

- A business registered or authorized to do business in Texas and has consented to serve as a registered agent.8

If an LLC member does not mind sacrificing anonymity, needing to update records with each move, that LLC member may serve as the registered agent. Otherwise, a third-party, professional registered agent is usually best. The choice of a registered agent is explained in more detail in our discussion of registered agents.

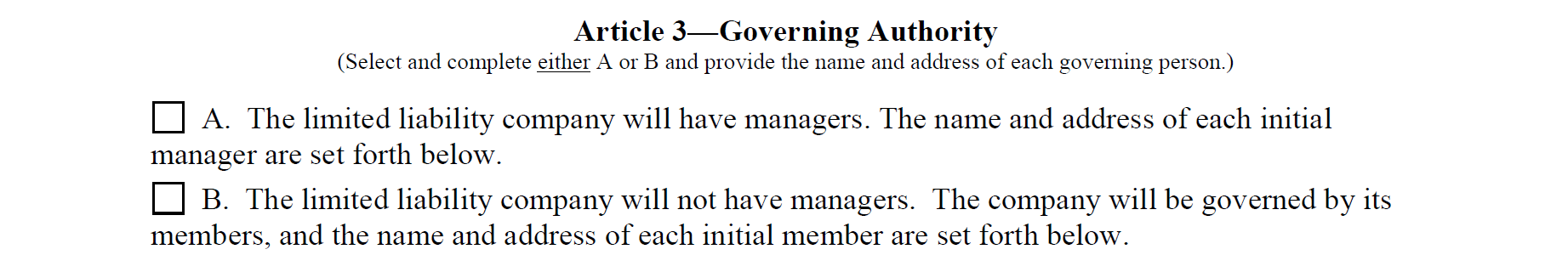

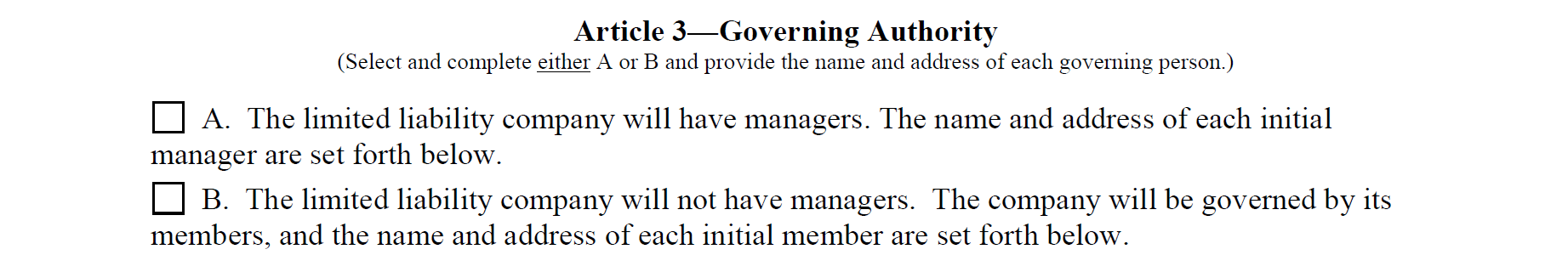

Article 3: Management Structure

The LLC manager is perhaps the only strategic decision on Form 205. Texas law permits two types of management structures:

- Member-Managed LLC. All members may bind the LLC to contracts and to make day-to-day decisions regarding the operation of the LLC.

- Manager-Managed LLC. The members appoint one or more managers—who may or may not also be members—to manage the LLC. Only the managers may bind the LLC to contracts and participate in the day-to-day operation of the business.

Whether an LLC is member-managed or manager-managed has important legal consequences. As detailed in our comparison of member-managed LLCs to manager-managed LLCs, it is usually best to form the LLC as a manager-managed LLC, even if the same persons will serve as both members and managers. The management structure should be further detailed in the LLC operating agreement.

Article 4: LLC Purpose

Most Texas LLCs are formed for any purpose allowed by law. Form 205 includes the following default language, with no ability to opt out:

The purpose for which the company is formed is for the transaction of any and all lawful purposes for which a limited liability company may be organized under the Texas Business Organizations Code.

If the LLC founders want to form the LLC for a specific purpose, the LLC attorney must draft a customized certificate of formation. But forming an LLC for a specific purpose is rare. Using a general purpose provides flexibility without restricting the LLC or raising questions about whether the LLC may or may not take a specific action.

Supplemental Provisions/Information

The certificate of formation may also include any other provisions that are not inconsistent with Texas law. These provisions may be included in the Supplemental Provisions/Information section of Form 205, either by adding the provisions to Form 205 itself or by incorporating an attachment by reference.

The Supplemental Provisions/Information section is often used in two situations:

- Texas LLC Domestication. When moving an LLC to Texas from another state—a process called LLC domestication or conversion—Form 205 must include special language connecting the new (Texas) LLC to the LLC filing from the prior state. That language is usually included in the Supplemental Provisions/Information section.

- Texas Series LLCs. A Texas series LLC is a special form of LLC that allows the use of separate series to segregate assets for liability protection. Texas series LLC law requires the certificate of formation to provide notice of the limitation of liability provided by the series LLC.9 This notice is often included or referenced in the Supplemental Provisions/Information section.

The Supplemental Provisions/Information might include other information about the LLC’s ownership, governance, business, and internal affairs. But including this information in the certificate of formation is not only unnecessary, but also makes private information about the LLC a matter of public record. The better approach is to include the details about the LLC in the LLC’s operating agreement.

- Tex. Bus. Orgs. Code Ann. § 1.002(36). See also Tex. Bus. Orgs. Code Ann. § 101.052, providing that the company agreement is the second company document governing the internal affairs of the LLC.

- Tex. Bus. Orgs. Code Ann. § 5.056.

- Tex. Bus. Orgs. Code Ann. § 5.059.

- Bus. Orgs. Code Ann. § 5.061.

- Bus. Orgs. Code Ann. § 5.062.

- Bus. Orgs. Code Ann. § 5.052.

- Bus. Orgs. Code Ann. § 5.053.

- Bus. Orgs. Code Ann. § 5.201.

- Bus. Orgs. Code Ann. § 101.602.